Search Our Knowledgebase (Windows; U.S.)

Requirements for W-2 or 1099 eFiling

In order to eFile W2 and 1099 filings with Aatrix all that is required is that you are enrolled and have the username and password.

Requirements for Federal eFiling

Aatrix will need to get an EFTPS Pin established for each taxpayer EIN that will be doing Federal Tax Deposits (EFTPS) with Aatrix.

- For more information, please read EFTPS.

If you plan on filing 94X series return reports (I.E. 941 Quarterly Return or 940, 943, 945 Annual Return)

To eFile 94X series reports with Aatrix, there is additional information needed for eFiling.

- For more information please read 94X Series Signatures.

Requirements for State eFiling

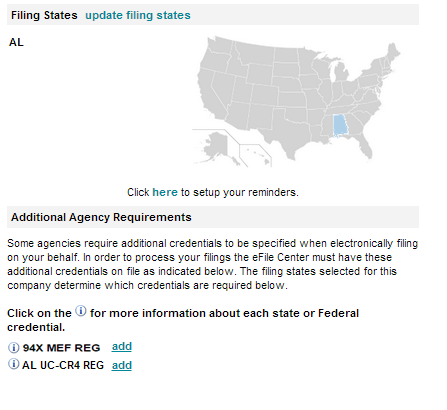

To see if there are any additional agency requirements for one of your filing states, first make sure that your filing states are selected above the additional agency requirements section.

Once the filing states have been selected, the states additional agency requirements will be listed below, if applicable.

You can click on the information icon “i” to the left side of the state item to get more information about the requirements and instructions on how to configure them properly.