What Has Changed On The 2020 W-2

Nov 10, 2020

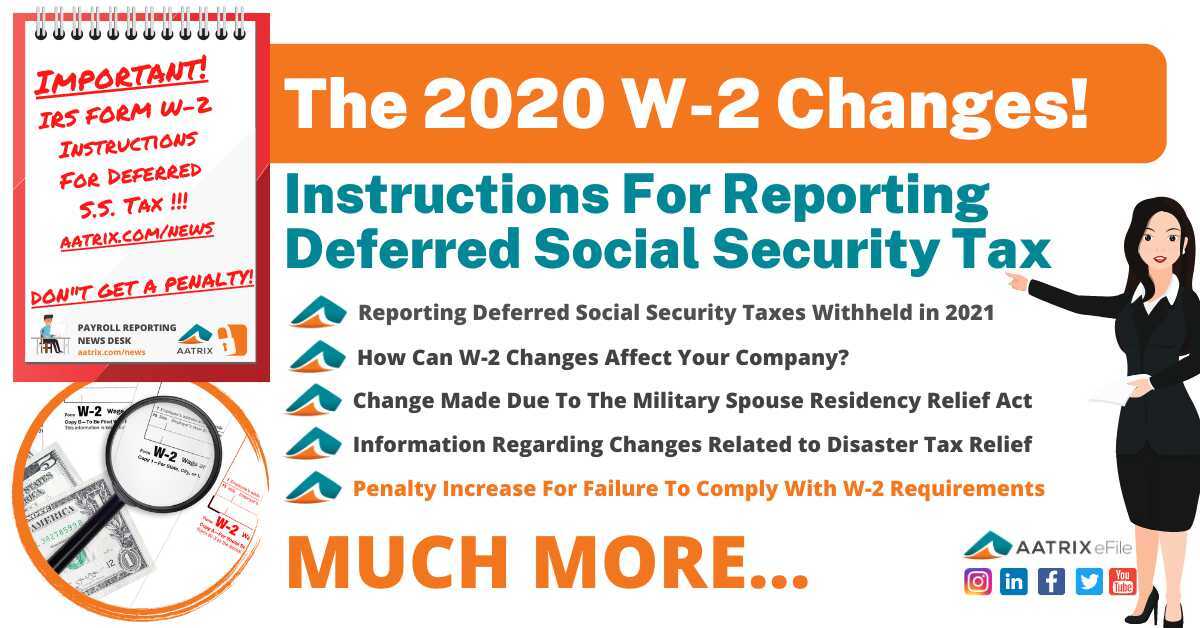

What Has Changed On The 2020 W-2

Instructions For Reporting Deferred Social Security Tax

The IRS has issued instructions for reporting deferred Social Security Taxes for employees using Form W-2 and W-2C.

Reporting Deferred Social Security Taxes

If you deferred the employee portion of Social Security tax under Notice 2020-65, when reporting total Social Security wages paid to an employee on Form W-2, Wage and Tax Statement, include any wages for which you deferred withholding and payment of employee Social Security tax in box 3 (Social security wages) and/or box 7 (Social security tips). However, do not include in box 4 (Social security tax withheld) any amount of deferred employee Social Security tax that has not been withheld.

Reporting Deferred Social Security Taxes Withheld in 2021

Treasury and the IRS issued Notice 2020-65 on August 28, 2020. The Notice allows employers the option to defer the employee portion of Social Security tax from September 1, 2020 through December 31, 2020. To pay the deferred amount of the employee portion of Social Security tax, the employer will withhold the amount of Social Security tax deferred from the employees' paychecks from January 1, 2021 through April 30, 2021.

Employee Social Security tax deferred in 2020 that is withheld in 2021 and was not reported on the 2020 Form W-2 should be reported in box 4 (Social security tax withheld) on Form W-2c. On Form W-2c, employers should enter tax year 2020 in box c and adjust the amount previously reported in box 4 of the Form W-2 to include the deferred amounts that were withheld in 2021. All Forms W-2c should be filed with SSA, along with Form W-3c, Transmittal of Corrected Wage and Tax Statements, as soon as possible after you have finished withholding the deferred amounts. See the 2021 General Instructions for Forms W-2 and W-3 (to be published in January 2021) for more information.

How Can W-2 Changes Affect Your Company?

It’s important to know what changes have been made to the W-2 filing process. Not complying with changes can lead to file rejections, delays for delivery of employee copies, and added costs of reprinting corrected W-2s and refiling Federal and State copies.

W-2 Security Changes

Due to security concerns the SSA now allows employers to truncate the social security numbers on employee W-2 copies. W-2s have been stolen from mailboxes, out of vehicles, and shared residencies. Truncating employee W-2s is a way to eliminate the ability of these thieves to file false information and claim refunds.

Employers may not truncate the SSN on copy A which is sent to the SSA.

Change Made Due To The Military Spouse Residency Relief Act

Due to a change to the MSRRA civilian spouses of service-members can elect to use the same residence for purposes of taxation as the service-member. Information is available at https://download.militaryonesource.mil/12038/MOS/Misc%20Files/MilSpouseResReliefAct.pdf.

There has been a clarification on code P reporting in Box 12 of the W-2. Employers should only report moving expenses reimbursements paid directly to a member of the U.S. Armed Forces who moves per a military order and incident to a permanent change of station, which are excludable under section 132(g) of the Internal Revenue Code.

Change Made For Employers Subject to The Railroad Retirement Tax

Awards compensating employees for lost wages are subject to Railroad Retirement Tax. The U.S. Supreme Court ruled that award payments to employees to compensate for working time lost due to an on-the-job injury is taxable “compensation” under the Railroad Retirement Tax Act (RRTA). If you are a railroad employer, you must withhold Tier 1 and Tier 2 taxes when you pay such awards to employees covered by the RRTA.

Information Regarding Changes Related to Disaster Tax Relief

Disaster tax relief. Disaster tax relief is available for those affected by recent disasters. For more information about disaster relief, go to https://www.irs.gov/newsroom/tax-relief-in-disaster-situations.

Penalties Have Increase For Failure To Comply With W-2 Filing Requirements

According to the IRS W-2 Instructions For 2020:

Failure to file correct information returns by the due date. If you fail to file a correct Form W-2 by the due date and cannot show reasonable cause, you may be subject to a penalty as provided under section 6721. The penalty applies if you:

• Fail to file timely,

• Fail to include all information required to be shown on Form W-2,

• Include incorrect information on Form W-2,

• File on paper forms when you are required to e-file,

• Report an incorrect TIN,

• Fail to report a TIN, or

• Fail to file paper Forms W-2 that are machine readable.

The amount of the penalty is based on when you file the correct Form W-2. Penalties are indexed for inflation. The penalty amounts shown below apply to filings due after December 31, 2020.

The penalty is:

• $50 per Form W-2 if you correctly file within 30 days of the due date; the maximum penalty is $565,000 per year ($197,500 for small businesses, defined in Small businesses).

• $110 per Form W-2 if you correctly file more than 30 days after the due date but by August 1; the maximum penalty is $1,696,000 per year ($565,000 for small businesses).

• $280 per Form W-2 if you file after August 1, do not file corrections, or do not file required Forms W-2; the maximum penalty is $3,392,000 per year ($1,130,500 for small businesses).

For more information the complete instructions for the 2020 W-2 are available at: https://www.irs.gov/pub/irs-pdf/iw2w3.pdf

Aatrix Software is a leading provider of payroll tax reporting and single-point eFiling services. Over 300,000 businesses use Aatrix for payroll reporting in the US and Canada and processes millions of W-2s annually.

Our customers say it best!

“Aatrix is very easy to use and takes the pressure out of eFiling and using the correct forms. I remember when the social security number was moved a few years ago on the W2. It didn't matter that I didn't know before filing because Aatrix already had the correct form in the correct format!”

Frank's Piggly Wiggly

For more information go to: https://wwwtest.aatrix.com/efile/