How to Deliver Your Employee W-2s Online

Dec 07, 2020

How to Deliver Your Employee W-2s Online

Eliminate Paper Entirely for Your W-2 Reporting!

It’s Not 2001

It is in fact 2020

How many day-to-day business functions do you do the same way as you did in 2001?

Many businesses persist in doing W-2s the same way they have for years. Printing and mailing employee W-2s is costly, time-consuming, and the least secure option for completing W-2 distribution.

Electronic W-2 delivery is efficient, affordable, and the most secure delivery method available for employee W-2s.

Security

Delivering electronic W-2s through a password-protected secure account eliminates many risks for paper W-2s which can be lost in the mail or compromised during the delivery process. electronic W-2 services allow businesses to maintain control of employee passwords while offering the highest security to ensure the employee’s confidential data is protected and only accessible to the intended individual.

Employees that use tax filing software can allow these solutions to access their electronic W-2 directly eliminating transcription errors and the need to print and mail tax forms themselves. This can provide ultimate security throughout the entire reporting process.

IRS Form W-2 Cost Savings

Using electronic W-2 delivery eliminates the costs associated with paper forms, envelopes, printing supplies, postage, and the onerous time-consuming task of printing in-house as well as the labor costs associated with that effort. Payroll administrators have dreaded this annual interruption of their normal duties and business owners cringe at the ever-increasing cost of getting W-2s to their employees.

Electronic W-2 delivery eliminates both concerns. Electronic W-2s can typically be done for less than $1 per employee as opposed to typical in-house costs of more than $4 per employee.

Additional Benefits

Electronic W-2s provide the additional benefits of providing access to employee W-2s from anywhere eliminating the need to reprint lost W-2s, replacing W-2s delivered to an old address, and waiting for the US mail to be delivered. Electronic W-2s are available as soon as they are filed and can be accessed by employees from anywhere.

Electronic W-2s can often allow employees to upload their W-2 directly into popular tax preparation software (ie TurboTax, H & R Block, and Tax Act).

How Does Delivering Electronic W-2s Filing Work

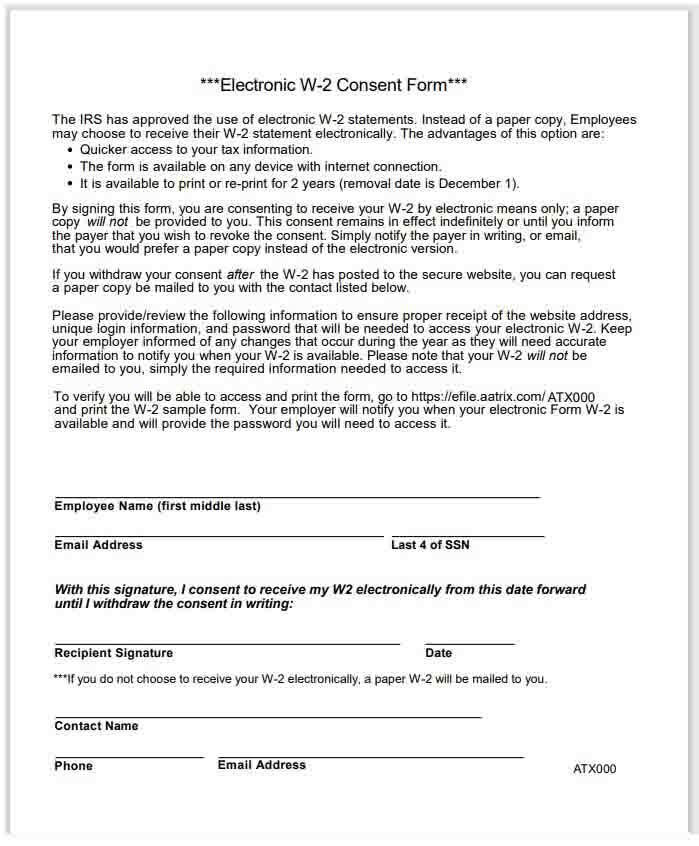

The only additional one-time effort is the need to get permission from your employees to accept electronic delivery. This is done on a single form that needs to be signed by the employee. The form explains how the electronic W-2 is to be accessed and is typically added to the employer’s new hire documentation and a one-time effort to contact existing employees. The Consent Form must contain the following information:

The employee must be informed that he or she will receive a paper Form W-2 if consent isn’t given to receive it electronically.

• The employee must be informed of the scope and duration of the consent.

• The employee must be informed of any procedure for obtaining a paper copy of his or her Form W-2 and whether or not the request for a paper statement is treated as a withdrawal of his or her consent to receiving his or her Form W-2 electronically.

• The employee must be notified about how to withdraw a consent and the effective date and manner by which the employer will confirm the withdrawn consent.

• The employee must also be notified that the withdrawn consent doesn't apply to the previously issued Forms W-2.

• The employee must be informed about any conditions under which electronic Forms W-2 will no longer be furnished (for example, termination of employment).

• The employee must be informed of any procedures for updating his or her contact information that enables the employer to provide electronic Forms W-2.

• The employer must notify the employee of any changes to the employer's contact information.

The following form is the Electronic W-2 Consent Form Aatrix provides its customers:

The solution you choose for electronic delivery should include this option as part of a complete service that e-Files State, Fed, and local W2s

Aatrix Software is a leading provider of payroll tax reporting and single-point eFiling services. Over 300,000 businesses use Aatrix for payroll reporting in the US and Canada.

Our customers say it best!

"Very easy to use and the cost is very reasonable. It's a great option to have a near hands-off way to submit W2/W3".Century Care Management