Using Sage 100 eFiling powered by Aatrix

Enroll Now!

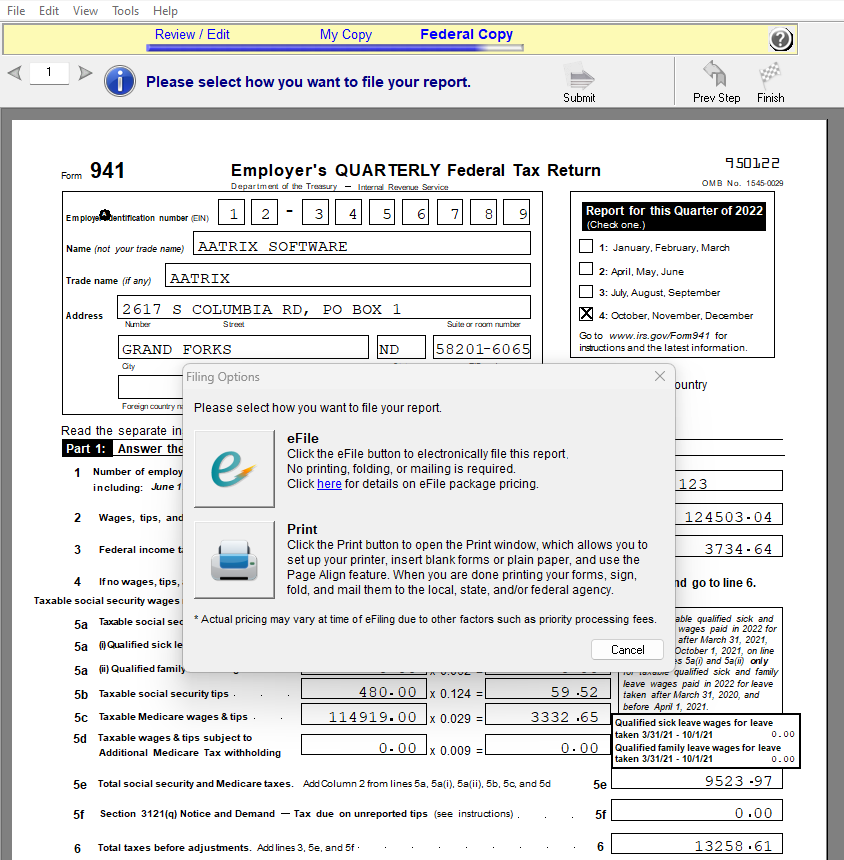

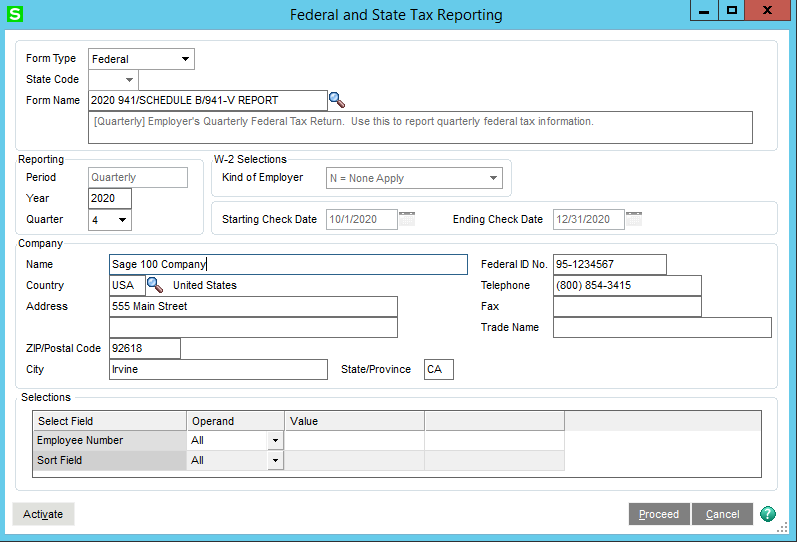

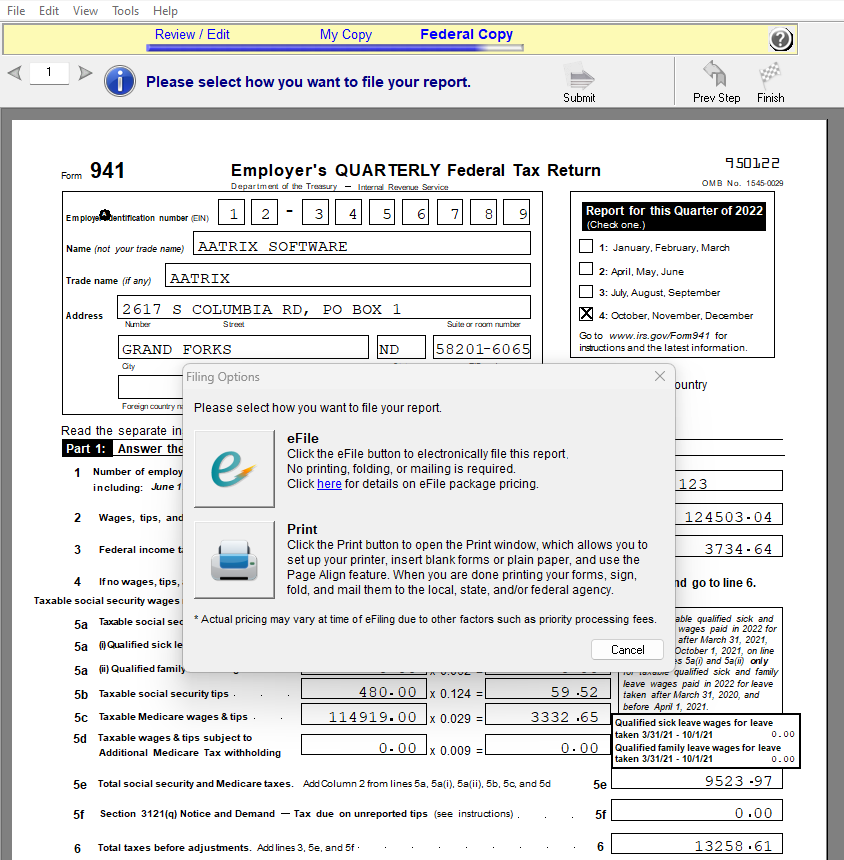

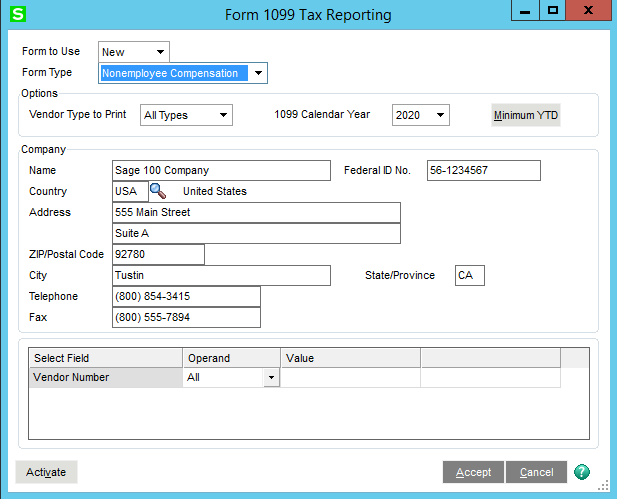

Streamline your tax reporting process with Sage 100 Federal and State eFiling and Reporting. Eliminate manual form creation and save time by choosing from over 330 federal and state forms for Unemployment, Withholdings, New Hire reports, W-2s, W-3s, and 1099s. The electronic forms will look very familiar, as they are a replica of the government forms you would receive in the mail. Except the form that will appear on your screen won't be blank- much of the information will already be filled out for you by your Sage 100 system. View and edit the information easily on your system, and once you've verified it's the way you want it, the form is ready to print or eFile. Once you eFile, you'll receive an email confirmation that the file was received. The form is processed and sent to the appropriate agency using an approved method.

Going paperless has never been easier!

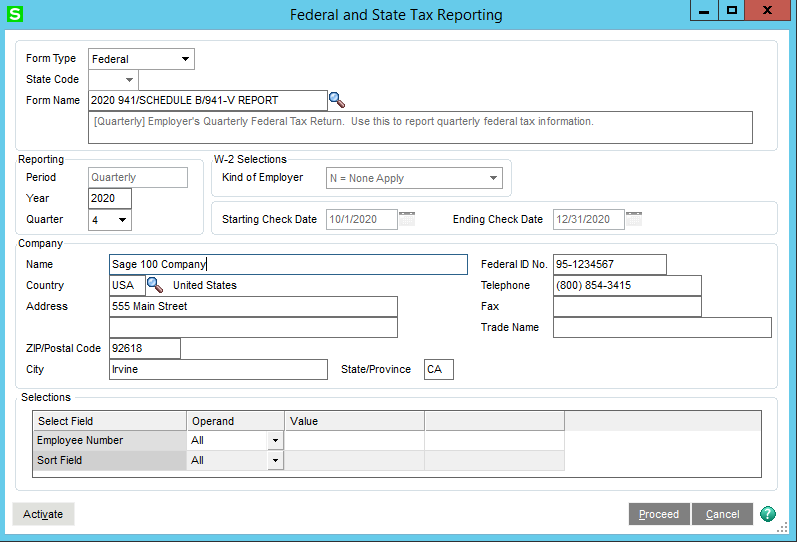

User Interface (Payroll)

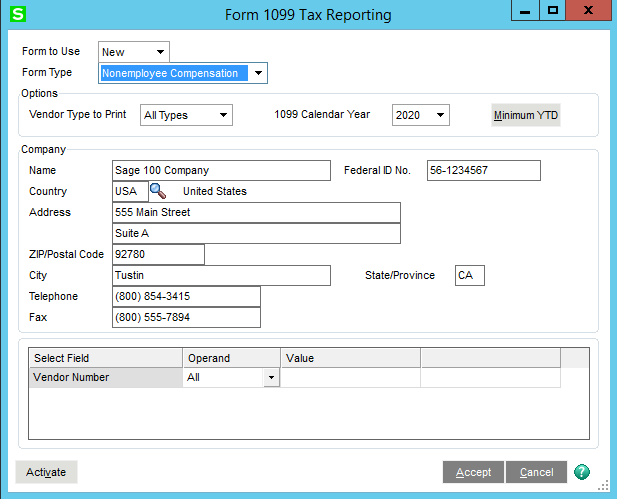

User Interface (1099s)

W-2 and 1099 eFiling Service

Once you register with the eFile center, all your W-2 and 1099 filings can be completed easily, saving time and money. No more folding, stuffing, or mailing.

Complete eFile Service

Our center will file your State and Federal W-2s and 1099 and mail the employee's W-2s or recipient's 1099s directly to them. Or, save even more time and money and go completely green. Offer your employees their W-2s over a secured website. No more reprinting lost W-2s. Simply provide your employees their login information and they print their own. Your employees will have access to their W-2 information 24/7, anytime, anywhere they have an Internet connection.

Sage Software, Sage 100® Logo is a registered trademark and service mark of Sage Software, Inc. in the United States and other countries. Aatrix is not a part of or affiliated with Sage Software, Inc.