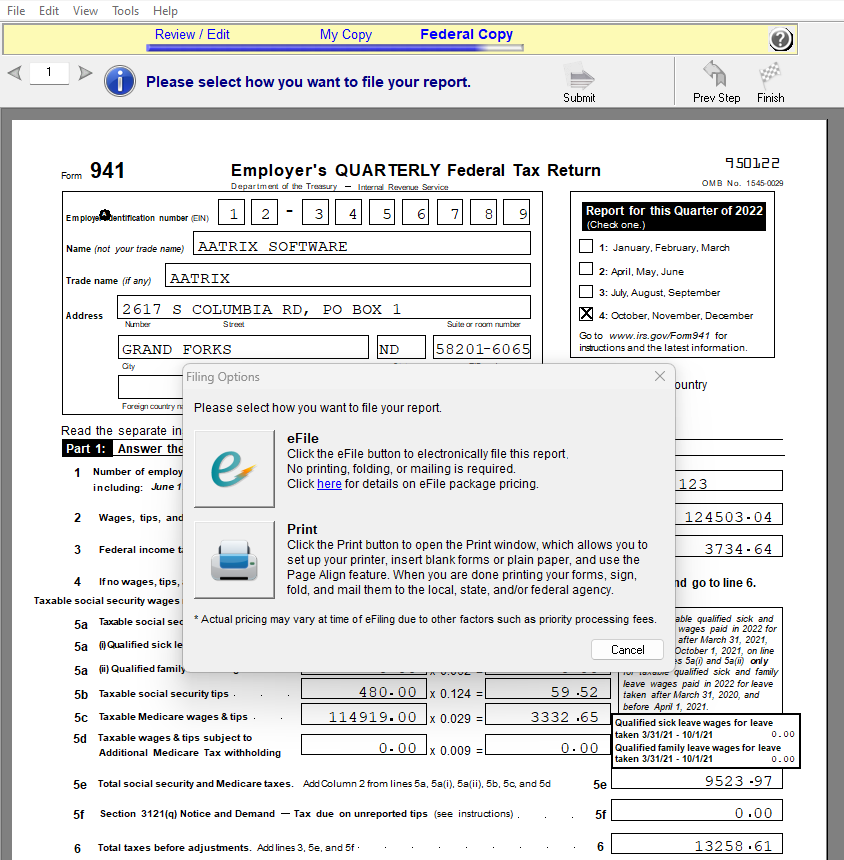

Meet all State and Federal reporting and payment requirements right from your Sage HRMS Payroll software with Sage Payroll Tax Forms and eFiling by Aatrix®

Enroll Now!

Sage Payroll Tax Forms and

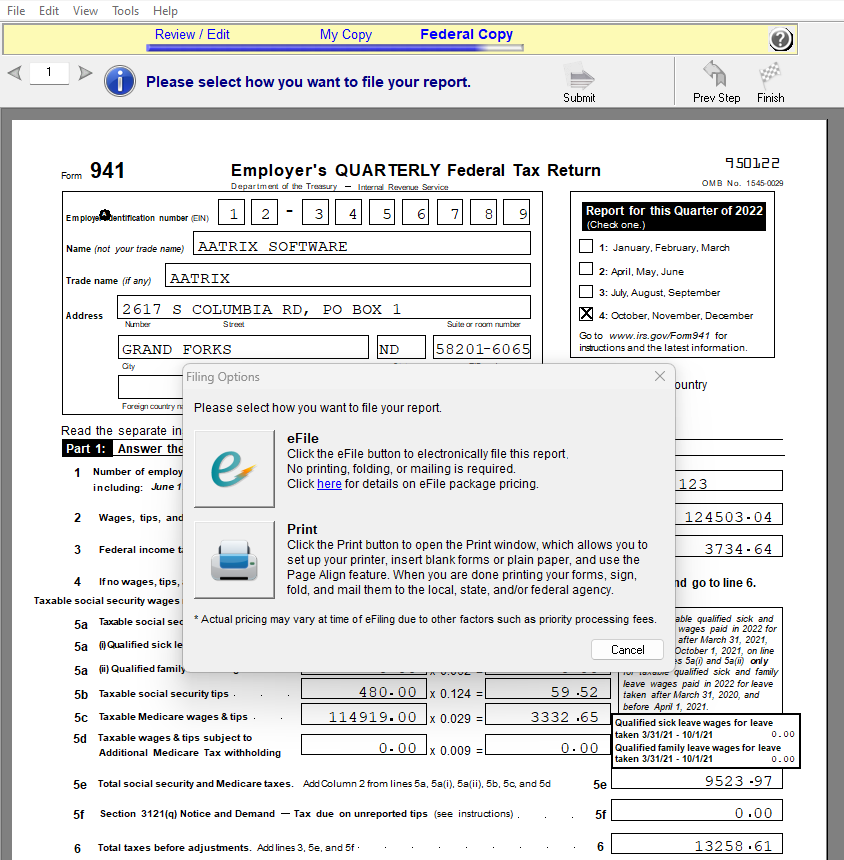

eFiling by Aatrix® is easy to use and saves you time by eliminating the need to create reports manually. Reports are automatically completed, reviewed, and edited on screen, then e-Filed in minutes for processing. This service insures 100% compliance by providing a guaranteed delivery method and eliminates many filing expenses associated with printing and mailing activities. You can rest assured knowing your files are protected using multiple levels of security.

Sage HRMS Payroll helps companies optimize their HR and payroll business processes as well as maximize their Return On Employee Investment (ROEI)™. With

Sage HRMS Payroll, you can successfully meet and respond to the HR and payroll management challenges you face every day. By automating and streamlining your day-to-day HR and payroll business processes using

Sage HRMS Payroll, Sage Payroll Tax Forms and

eFiling by Aatrix®, you and your staff are freed up to spend more time and energy on the business asset that is most vital to your company—your employees.

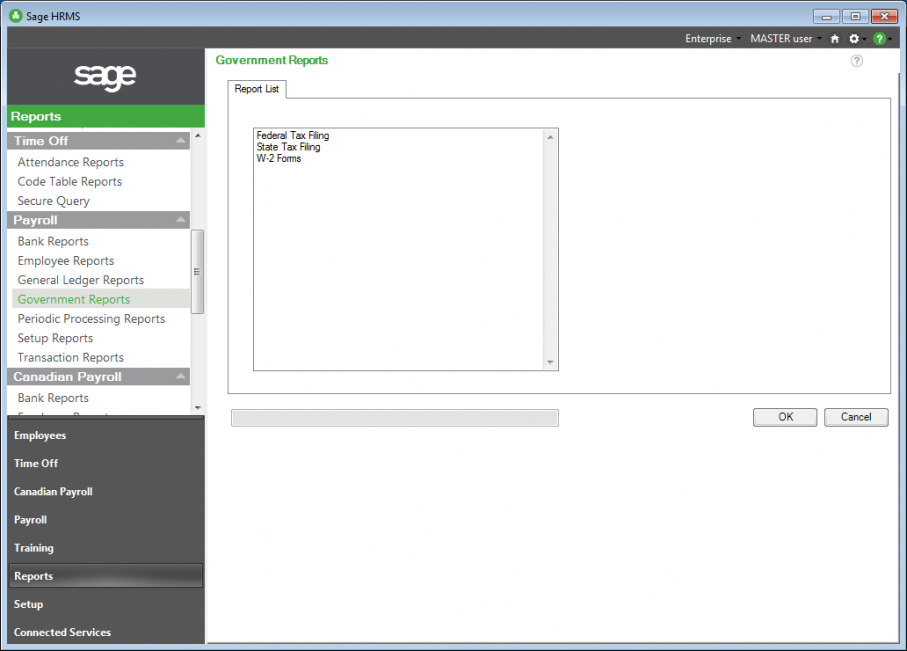

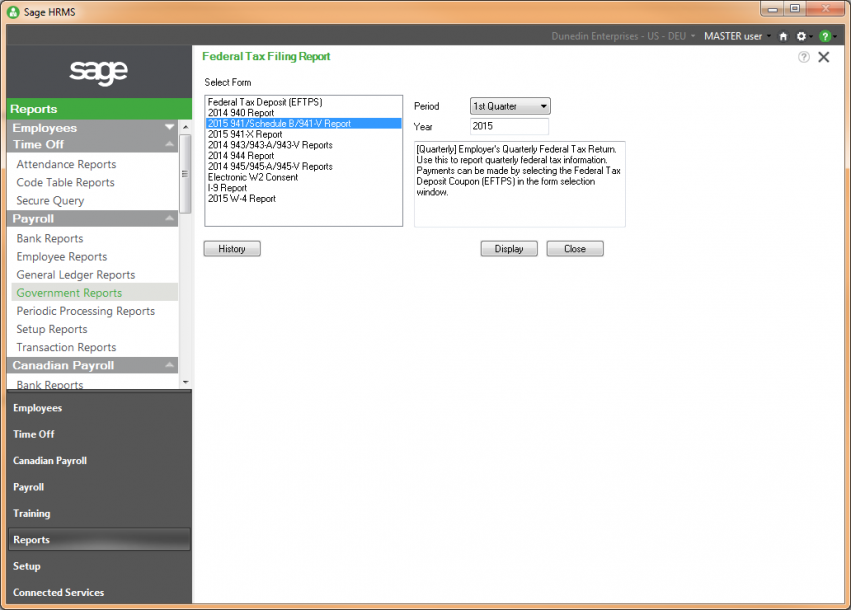

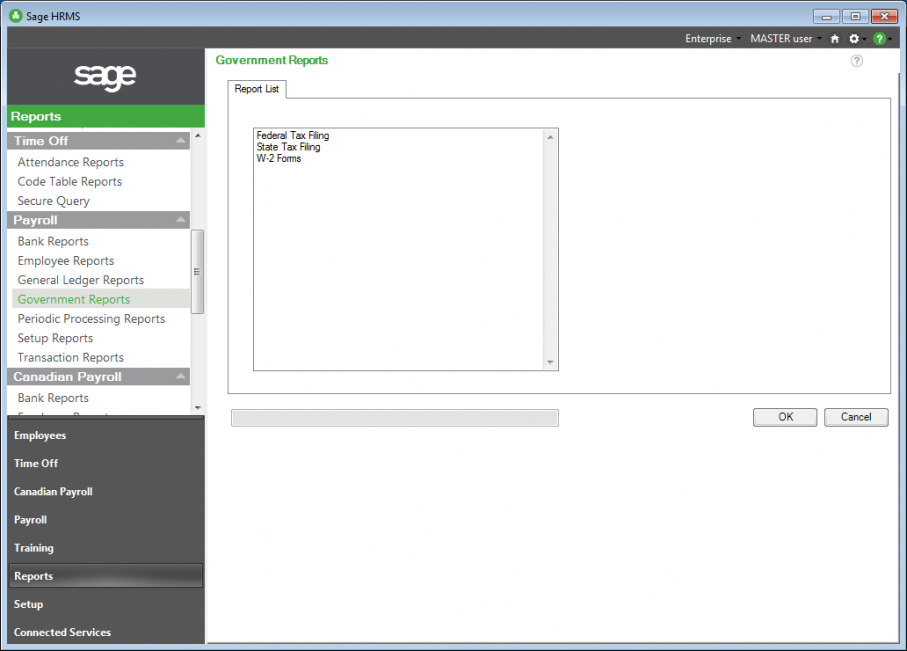

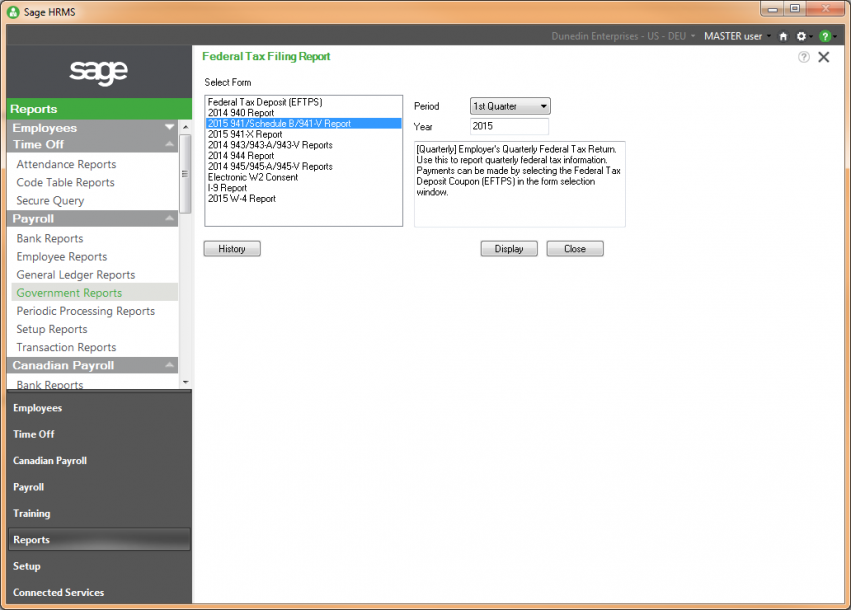

User Interface

Complete W-2 eFile Service simplifies filing and saves you money!

- File your State and Federal W-2s and mail the employee W-2s directly to them in a fraction of the time it has taken in the past.

- Aatrix Payroll eFile Center has added the ability to deliver your employees W-2s via a secured website for instant access.

- No more reprinting lost or bad address W-2s. Simply provide your employee or ex-employee their login information and they print their own W-2s.

- W-2s can be accessed from anywhere, anytime.

- You can now accomplish this task quickly, accurately, for an amazingly low price.

Sage Software, Sage HRMS® Logo is a registered trademark and service mark of Sage Software, Inc. in the United States and other countries. Aatrix is not a part of or affiliated with Sage Software, Inc.