Search Our Knowledgebase (Windows; U.S.)

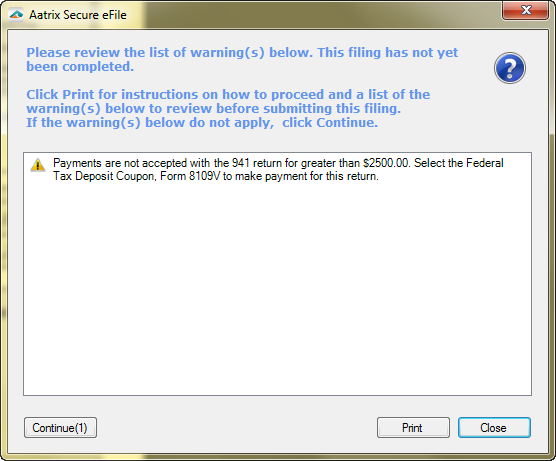

Payments are accepted during processing of the Federal 941 quarterly return. The payment must be under $2500.00 to be made at the same time as the 941 Form. If the payment amount exceeds the $2500.00 limit, the payment must be filed separately by using the Federal Tax Deposit Coupon (EFTPS/8109V) Form.

Note: If the amount due on the 941 Form is over $2500.00, the message above will appear to you.