Search Our Knowledgebase (Windows; U.S.)

To indicate you have employees or recipients that wish to receive an eW-2/e1099 only and not receive a paper copy, here are some things to note.

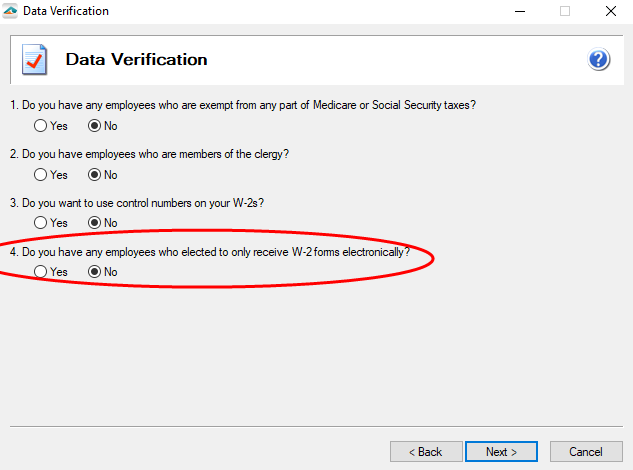

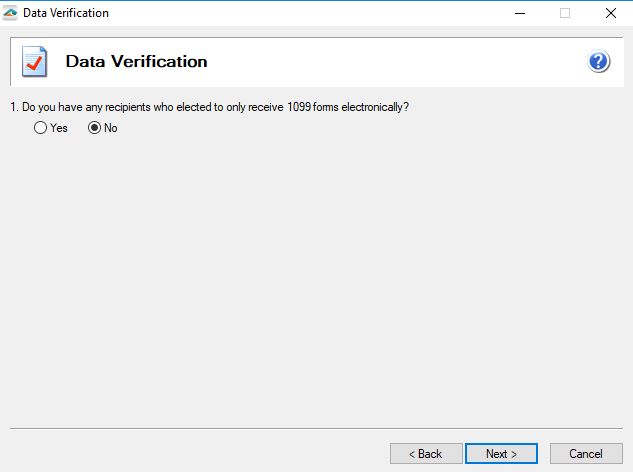

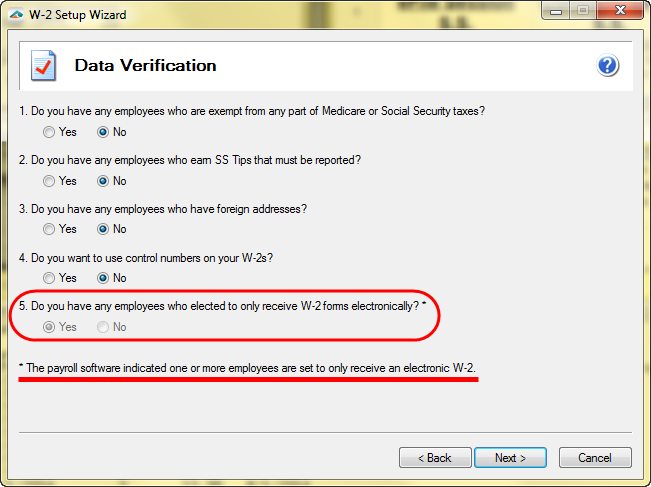

- To indicate that you do have employees/recipients that are going to receive an electronic W-2/1099 only, you must select this option in the "Company Setup", here is a screen shot of the W-2 and 1099 options.

Note: This option automatically defaults to “No”, it must be manually changed if “Yes”.

- If your payroll software allows you to enter in your employee/recipient email address, when that information gets passed to us, we will automatically check the "Yes" option and grey out the box.

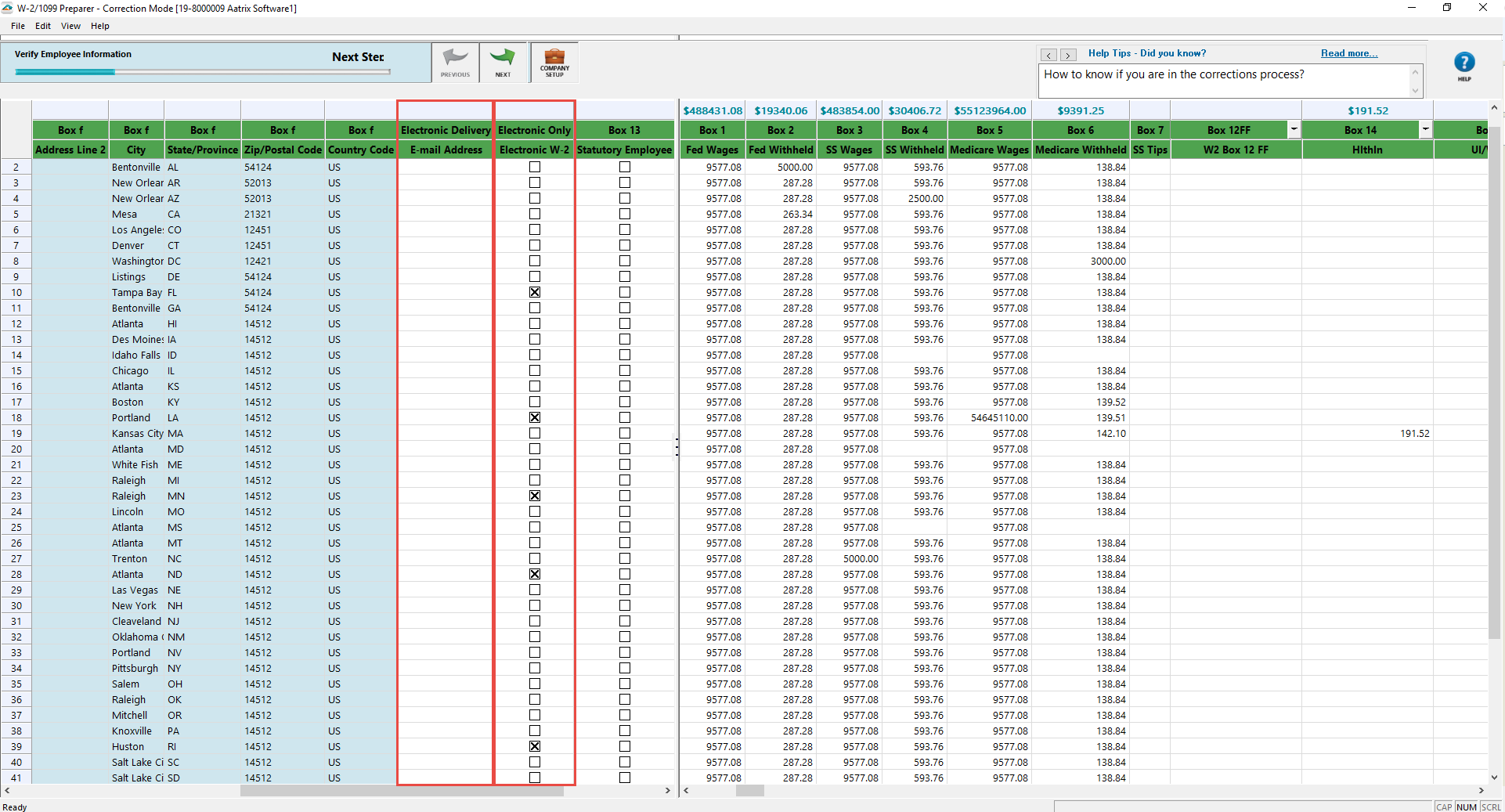

- Once you have completed the "Company Setup", you will then enter into the Preparer.

- Here you will have to make sure an email address is entered and the "Electronic Only" column has the appropriate check boxes checked.

- To enter in an email address manually, you simply select the email address box in the appropriate row of the employee/recipient and enter it in.

- The eW-2/e1099 option is only available when choosing the complete option. The complete option includes the following services:

- Printing and mailing of employee/recipient copies

- eW-2/e1099 copies

- eFiling of state copies

- eFiling of federal copies

- eFiling of supported localities

Note: If you are not sure if your payroll software allows you to enter in employee/recipient email addresses, please contact their support department for more information.