Search Our Knowledgebase (Windows; U.S.)

If you have employees with foreign addresses, you can print or eFile their W-2s using the W-2 Preparer.

Follow these steps:

- Enter the W-2 Preparer from the Forms Selection screen. Select the W-2 form listed and select to process the report.

Note: Please note the process option may vary depending on your payroll software.

- Complete the Company Setup.

- Continue to the W-2 Preparer.

- The employee data will then populate into the Preparer for editing and review.

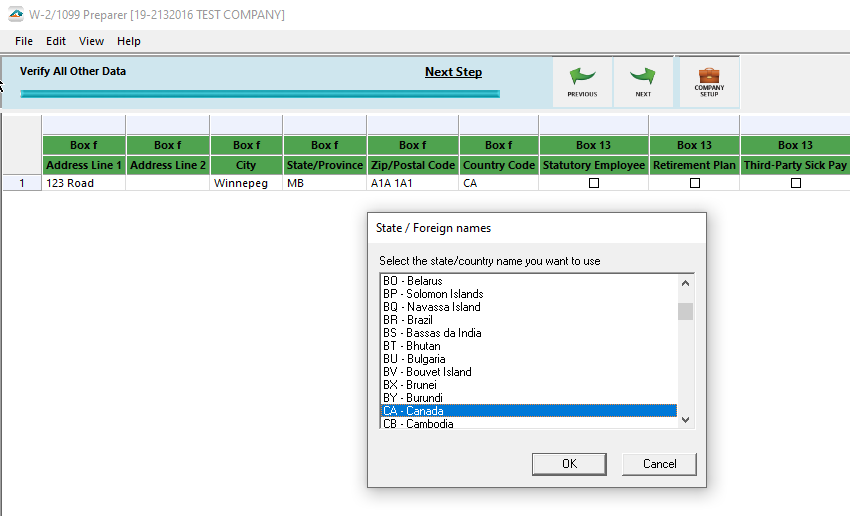

- Start by clicking on the Country Code to adjust to any foreign country.

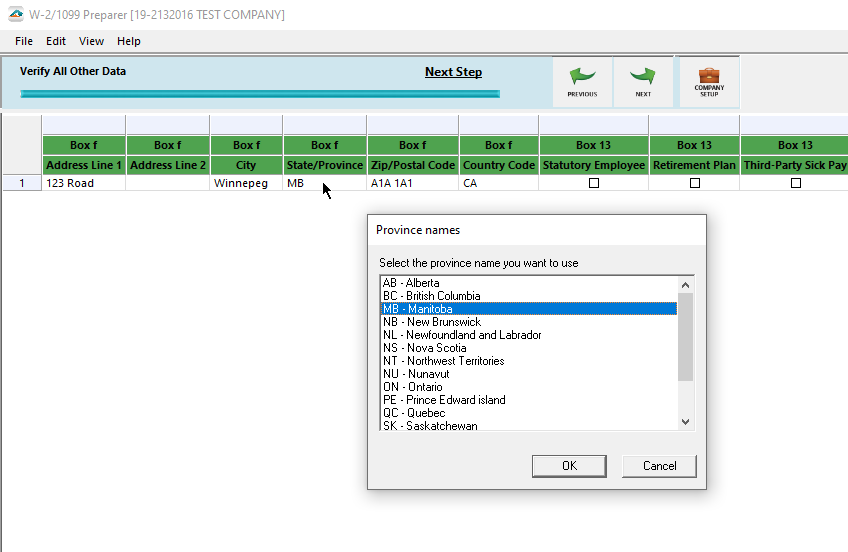

- Next, click on State/Providence to select the required location.

Note: Only CA and US come with a prepopulated Providence selection window. All other countries will be required to type out the State/Providence.

- The following rules apply when entering foreign addresses for applicable employees:

- Country Code must be selected from the drop-down menu.

- State/Province cannot be blank.

- Zip/Postal Code can not be blank and must use the correct format.

- Address Line 1 can not be blank.

- City can not be blank.

Once the information has been verified, continue through the W-2 Preparer. The W-2 forms will then be displayed for final review utilizing the data provided.