Is Aatrix supporting the ACA reporting?

Yes, Aatrix will be supporting the 6055 & 6056 reporting requirements. The information will be reported on the 1095/94-B or the 1095/94-C form sets.

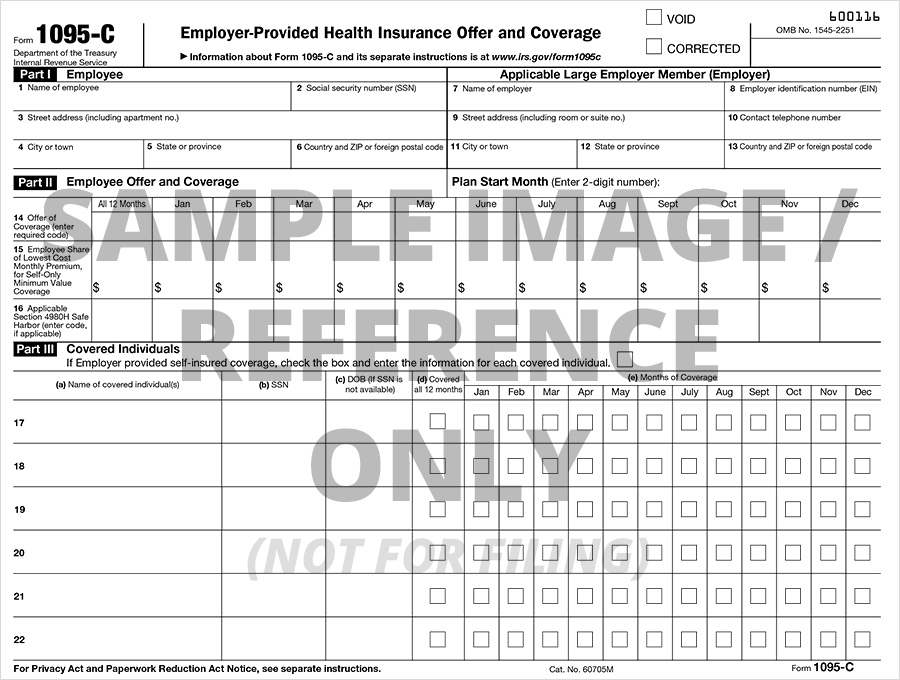

FORM 1095-C

Click on the individual boxes below for specific IRS Instructions

| Part I: Employee Applicable Large Employer Member (ALE Member/Employer) | |||||||||

|

| Part III: Covered Individuals |

| Part III Lines 17-22, Covered Individuals |

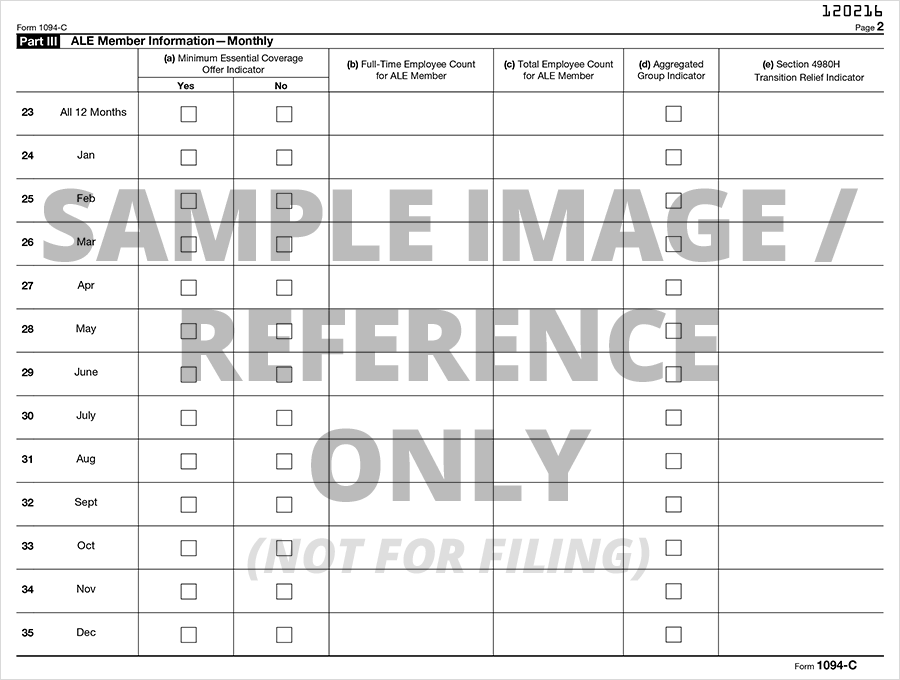

FORM 1094-C

Click on the individual boxes below for specific IRS Instructions

| Part II: ALE Member Information |

| Line 20, Total Number of Forms filed by and/or on behalf of the employer. |

| Line 21, ALE Member is part of Aggregated ALE Group |

| Line 22, Certifications of Eligibility |

| Part III: ALE Member Information — Monthly (Lines 23–35) |

| Column (a), Minimum Essential Coverage |

| Column (b), Full-Time Employee Count for ALE Member |

| Column (c), Total Employee Count for ALE Member |

| Column (d), Aggregated Group Indicator |

| Column (e), Aggregated Group Indicator |

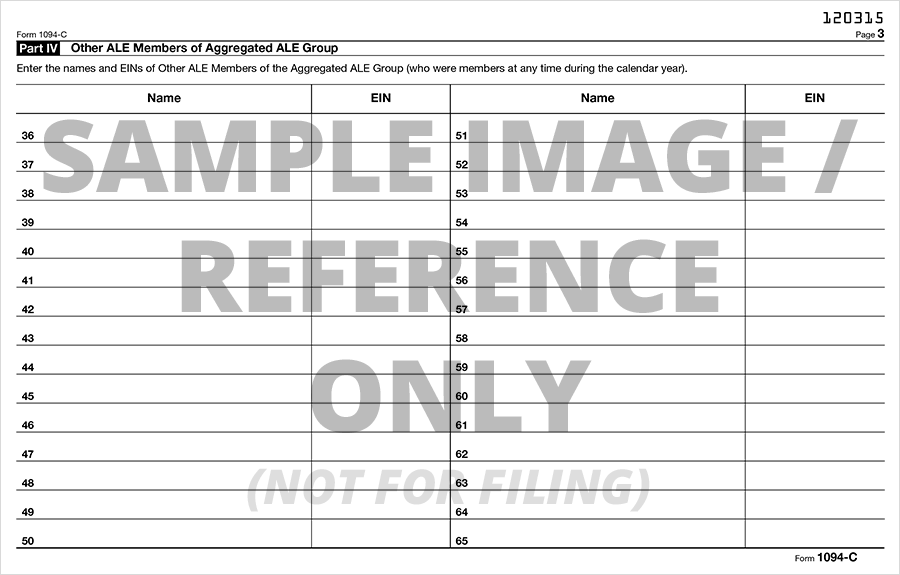

| Part IV: Other ALE Members of Aggregated ALE Group |

| Lines 36-65, Other ALE Members of Aggregated ALE Group |

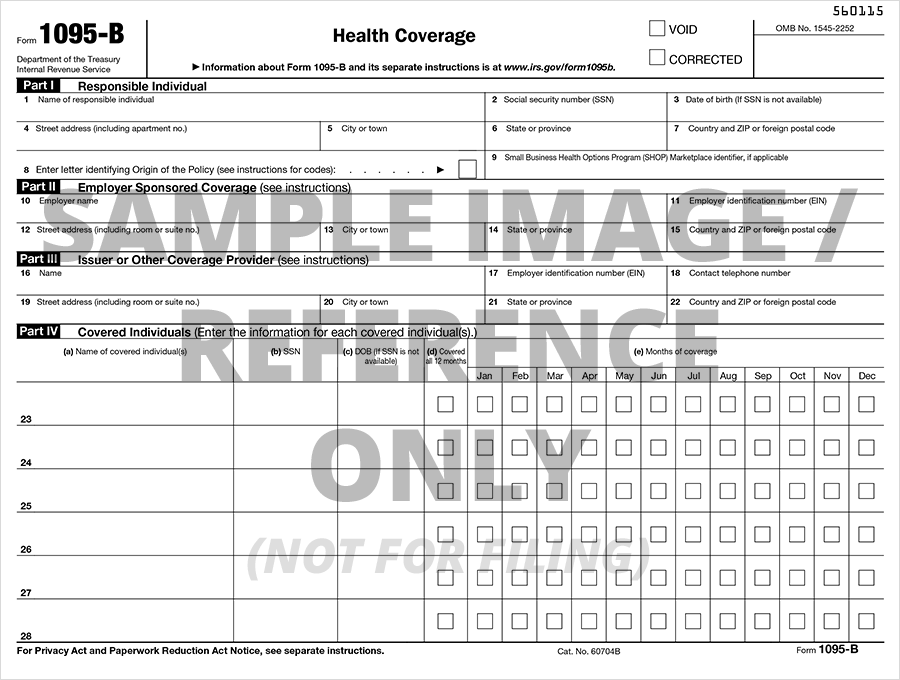

FORM 1095-B

Click on the individual boxes below for specific IRS Instructions

| Part I: Responsible Individual |

| Part II: Employer-Sponsored Coverage |

| Lines 10-15, Name, EIN, and Complete Mailing Address for the Employer Sponsoring the Coverage |

| Part III: Issuer or Other Coverage Provider |

| Lines 16-22, Name, EIN, and Complete Mailing Address of Issuer/ Other Coverage |

| Part IV: Covered Individuals |

| Column (a), Covered Individual's Name |

| Column (b), Covered Individual's Social Security Number (SSN) |

| Column (c), Covered Individual's Birthdate (MM/DD/YYY) if Social Security Number (SSN) is not available |

| Column (d), Covered all 12 months |

| Column (e), Months of Coverage |

| Part IV: Covered Individuals (Continuation) |

| Column (a), Name of each Covered Individual |

| Column (b), Social Security Number (SSN) of each Covered Individual |

| Column (c), Birthdate (MM/DD/YYY) of each Covered Individual if SSN is not available |

| Column (d), Individual Covered for 12 months |

| Column (e), Coverage each month if individual wasn't covered for all 12 months |

FORM 1094-B

Click on the individual boxes below for specific IRS Instructions

| Part IV: Covered Individuals (Continuation) |

| Line 1, Filer's Complete Name |

| Line 2, Filer's EIN |

| Lines 3 and 4, Contact Person's Name and Telephone Number |

| Lines 5-8, Filer's Complete Address |

| Line 9, Total number of 1095-B forms transmitted with 1094-B |