| STEP-BY-STEP INSTRUCTIONS |

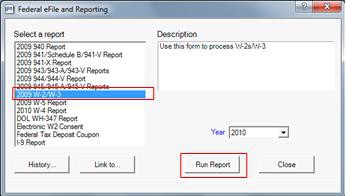

1. Select the W-2 Form. |

|

This will bring up a forms selection window, select "W-2/W-3" and click the "Run Report" button.

|

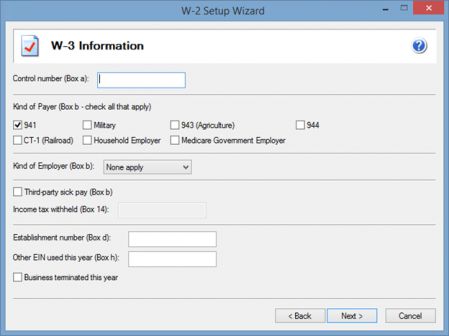

2. Review Company Information. |

|

A company setup wizard will take you through your company information that will display on the W-2/W-3 forms. All or most of the information will be populated from Sage 300 Online. |

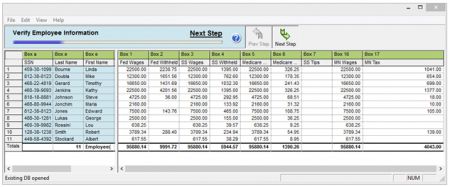

3. Review Employee Information. |

|

The wizard will take you into a grid displaying all of your employee data to review. Several data validations are performed during this step to ensure accuracy of your employee data and help elimination rejections. |

4. Select Your Filing Options. |

|

The complete eFile package is the best value but you can also eFile just your Federal and or State W-2s/W-3s as well as print all your W-2 copies. |

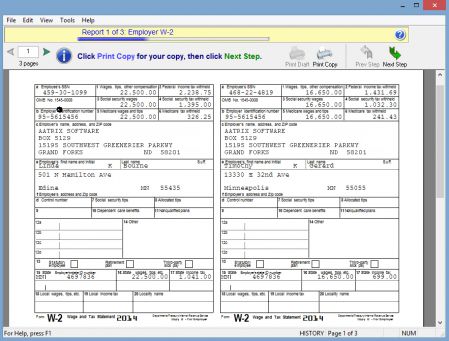

5. Review Your Forms. |

|

A Form Viewer will display your forms for review. You can print a record copy if eFiling or your official copy if printing and mailing. |

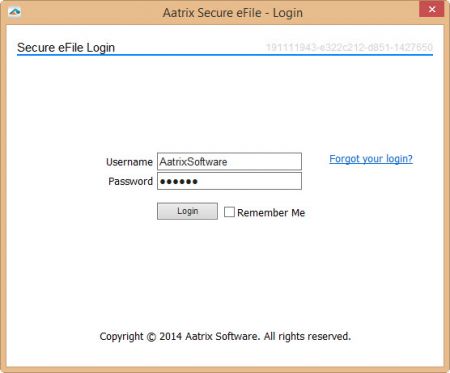

6. Submit Your Forms. |

|

An eFile wizard will guide you through submitting your forms to the eFile Center. Enrollment to the eFile center is required to obtain a username and password, click here to enroll now or you can enroll at time of eFiling. |

Includes Payroll Reports and Payments

with over 330+ U.S. State and Federal Forms